The quality improvement landscape has grown much more complex and touches a wider number of health plan functions than ever before. Quality measurement and reporting have evolved from an annual routine into a year-round strategic initiative as payers used quality data to drive performance improvement initiatives across their organizations.

To determine how organizational shifts might be affecting their strategy and planning, Verscend conducted a survey of health plan quality departments. Here, we summarize the results and offer insights gleaned from both Verscend and health plan experts.

Methodology

Verscend fielded the brief online survey in the fourth quarter of 2017, requesting participation from health plans of all sizes. The survey had 68 respondents, which broke down into three approximately equal groups by job title: quality managers; director, VP, and above; and “other,” such as data analysts. Respondents also broke into approximately equal groups by health plan size: small (fewer than 100,000 members), medium (100,000 to 499,999 members), and large (500,000 members and greater). Medicare and Medicaid made up the bulk of respondents’ membership, although commercial membership was also represented.

Survey Results

Here, we provide summary charts for each question in the survey in addition to perspectives on the findings.

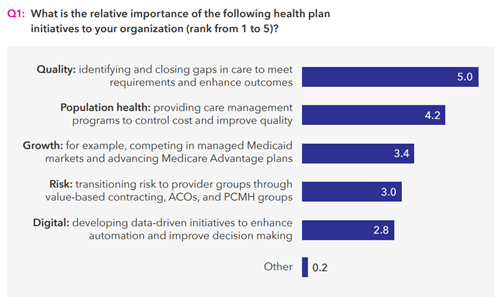

As Q1 reveals, closing gaps in care is still top of mind for quality teams, but respondents also indicated a significant awareness of population health initiatives that might not have been present as recently as five years ago, when quality improvement was viewed as more of an operational task performed for compliance and accreditation purposes. The high ranking for population health demonstrates the pressure that quality teams are receiving from groups both inside and outside of the health plan. In the context of cost control and quality improvement, both care management and provider network management teams are interested in quality data to better understand cost, utilization, and quality trends and corresponding improvement opportunities. Another key takeaway is the relatively low importance respondents placed on both transitioning providers to risk-based arrangements and developing data-driven initiatives. While both are major topics of conversation in the industry, they aren’t as much of a focus for health plans yet, at least from the quality improvement team’s perspective.

Q2 demonstrates that a health plan’s path to success in quality improvement still rests squarely with the provider, but the jury’s still out on the best model for driving successful provider engagement. Provider engagement is a part of every health plan’s strategy and investments, but not every plan is having success with investments such as provider portals. Health plans can’t just “build it and they will come.” Traditional face-time and an aggressive promotion strategy with provider groups are still very much required. Education is a big part of reaching providers and effecting change. Because one provider may be contacted by multiple health plans, each plan is fighting to be heard. The secret to success is ensuring that providers not only know what care gaps exist, but also what to do about them and what’s in it for them when they engage. The value proposition could range from something as simple as understanding what they are doing right for their patients due to clearer communication all the way to financial incentives for measurable improvement.

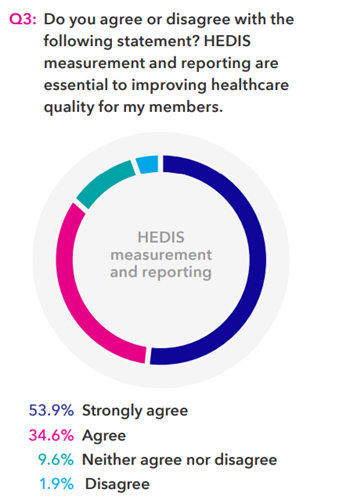

Q3 sought to establish a benchmark to assess the growing complexity of the quality measurement landscape as we conduct follow-up surveys over time. Clearly, the overwhelming majority believe that HEDIS measurement and reporting are essential to improving quality. However, the 11.5 percent of respondents who did not indicate agreement with the statement perhaps demonstrates a growing sentiment that there is or should be more to quality improvement than just HEDIS.

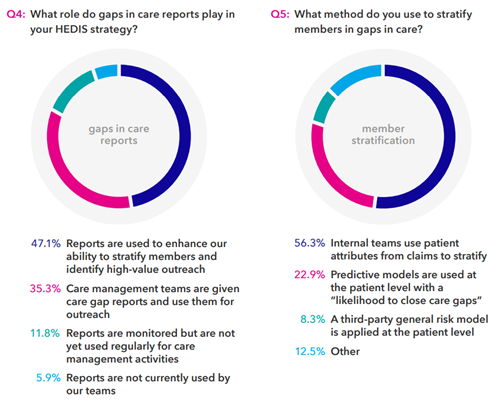

Identifying and closing gaps in care are the top priority for quality teams and their organizations, as we saw earlier. So, we wanted to dig a little deeper into their methodologies for doing so. As Q4 illustrates, gaps-in-care reports are obviously a critical tool for health plans to identify which members to target for their outreach efforts. Q5, however, reveals that less than a quarter of respondents are using predictive models to stratify their outreach lists. Taken together, these results suggest the potential for inefficient outreach to be prevalent in health plans. In addition, only 35 percent of respondents indicated that their care management teams are given the gaps-in-care reports, perhaps indicating that quality departments and care management departments remain largely siloed from each other. Similarly, for many years Verscend has worked with health plans to support the use of predictive models to stratify members for population health management programs. Interestingly, fewer than a quarter of respondents are using these same models in the quality improvement area. We will continue to monitor movement in this area to watch for trends over time.

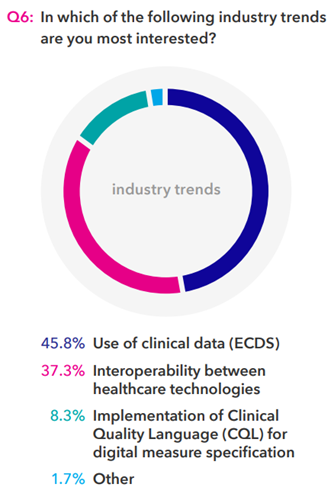

While responses to Q1 demonstrated that digital initiatives rank relatively low in importance among payers’ current initiatives, Q6 shows that health plans are clearly interested in and concerned about the integration of electronic clinical data. NCQA’s push toward electronic measures is undoubtedly a factor driving this interest, but their use is still optional for health plans at this point.

Keys to Success

Quality measurement is now a critical component of the industry’s transformation to value-based care delivery and payment systems. The quality department has a seat at the strategy table, but health plans don’t yet fully understand all the nuances of quality measurement, reporting, and improvement, and the ways in which this information and these processes impact all areas of their business. Payers looking to drive quality improvement as effectively as possible must think critically about investments in many areas: operational infrastructure, closing gaps in care, provider engagement, and member engagement. Of these priorities, improving provider engagement may be one of the most complex challenges that health plans face. Organizations are wise to deploy a variety of strategies, learning along the way how to tweak their programs based on what’s working and what isn’t. Understanding the provider’s perspective—competing priorities, lack of incentives, conflicting goals—can only help. Often, one of the most powerful tools that plans have at their disposal is benchmark data, risk adjusted to take varying patient-panel illness burden out of the equation.

Next Steps

Verscend will be conducting similar surveys throughout 2018. If you have additional question ideas, or if you would like to be included in the next survey, please contact us at info@verscend.com.